CP42 Fraud: EPPO dismantles customs fraud ring operating at Liège Airport – €310 million in estimated damages

News from @European Public Prosecutor's Office - EPPO

The European Public Prosecutor’s Office (EPPO) today, 28 March 2023, carried out ten searches in several locations in Belgium, including at Liège Airport, and arrested four suspects, during an operation against a customs fraud ring believed to have caused damages of up to €310 million in evaded tax and custom duties.

During the operation, carried out with the support of Europol, the Belgium Customs and VAT Authorities and several branches of the Belgian Police, officers raided storage premises and offices at Liège Airport and in Zeebrugge, as well as private houses of the suspects in Ans (Alleur), Liège and Visé, seizing evidence and assets.

On the radar of the EPPO’s European Delegated Prosecutors in Brussels in this investigation, code-named ‘Silk Road’, are Chinese exporters suspected of having put in place a complex system to evade the payment of VAT on imported goods, using three Belgian private customs agencies and a number of fake companies in several EU Member States.

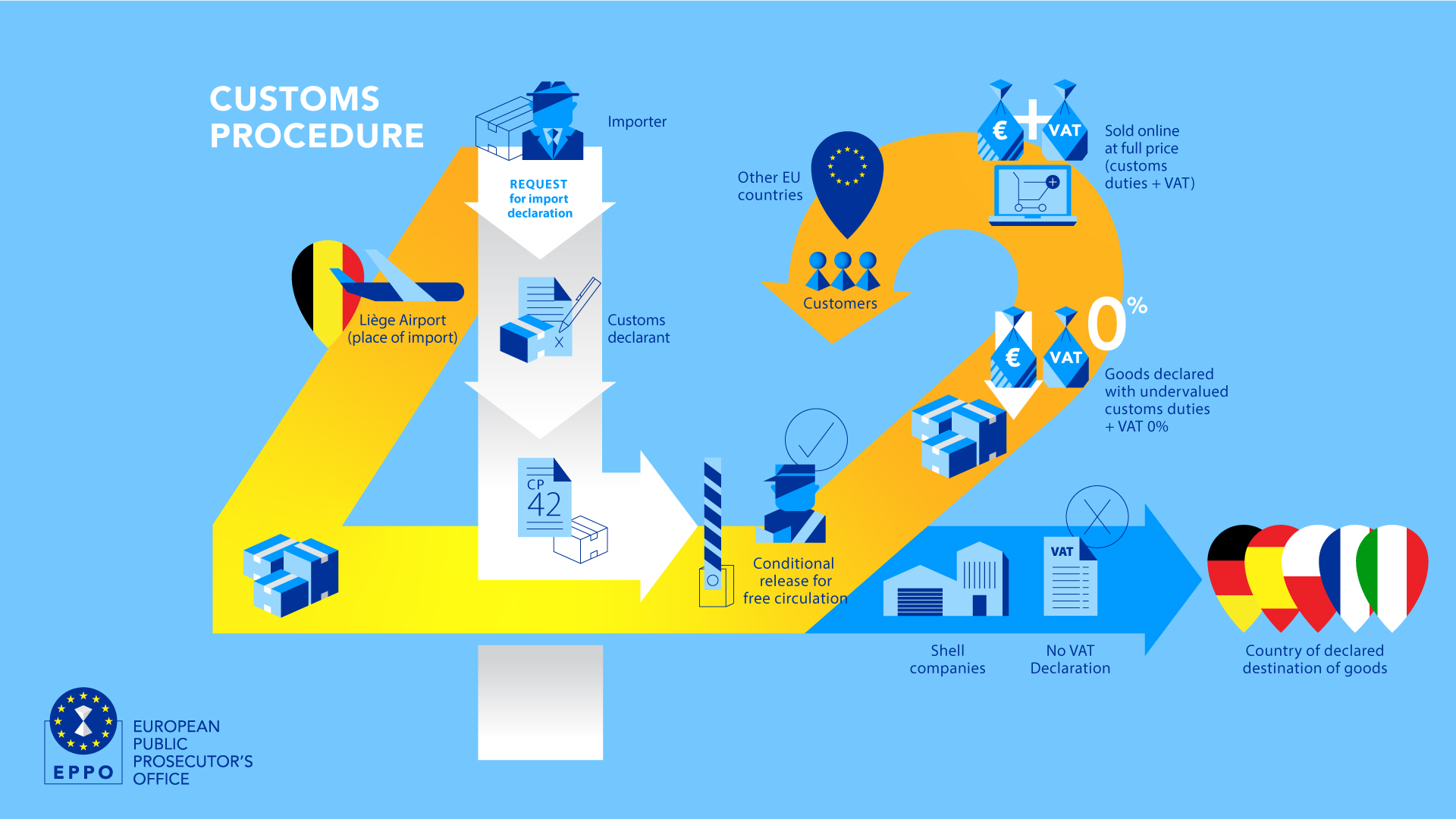

According to the investigation, the Belgian companies, acting as customs and VAT reliable representatives of the Chinese exporters, declared that the goods entering through Liège Airport – electronic equipment, toys and a myriad of accessories – were destined for other Member States, in order to benefit from a VAT import exemption based on the EU’s ‘Customs Procedure 42’ (CP42).

What is CP42 fraud?

Customs Procedure 42 exempts importers from paying VAT in the country of importation, if the imported goods are subsequently transported to another EU Member State. Under this procedure, created to simplify cross-border trade, VAT is exempted in the country of importation, when the goods are acquired in the final Member State of destination.

To benefit from this exemption, the Chinese exporters used private customs agencies/VAT reliable representatives in Belgium, who would declare that the final destination of the goods was in other Member States. In order to do so, they are believed to have used shell companies located in France, Germany, Hungary, Italy, Poland and Spain, using fake invoices and falsified transport documents. In some cases, they allegedly used the names of real companies, which were unaware that their VAT numbers and identities had been stolen.

However, in reality, the shell companies would not receive the goods, which were actually supplied to real companies established in other Member States, or sold to final consumers via online marketplaces in several countries. The purpose of these shell companies was to divert the attention of inspectors, creating a fake commercial chain and making it more difficult to carry out checks.

The goods would ultimately be sold to the final consumer, who would pay full price for the products, including VAT. However, according to the investigation, the VAT paid by the final consumer was never declared nor paid to any tax administration by the alleged criminal organisation, and was instead kept by the seller. This allowed for the goods to be sold at massive profits, while defrauding tax collection agencies of customs duties and VAT.

It is estimated that the activities under investigation have, between 2019 to 2022, caused damages of at least €303 million in evaded VAT and €6.6 million in custom duties.

The crimes under investigation include forgery, customs and VAT fraud, money laundering and participation in a criminal organisation.

At the EPPO’s request, the Belgian investigative judge issued a seizure order for computers and electronic devices (for gathering of evidence), as well as any asset with a value higher than €1000.

Among the suspects arrested today are two directors, one accountant and another employee of the Belgian companies under investigation.

Today’s operation also allowed for the freezing of a dozen bank accounts and the seizure of four cars (including brands like Audi, BMW and Mini Cooper).

Cooperation with partners

The facts under examination were brought to the attention of the EPPO by the Belgian Customs authorities and investigations by the European Anti-Fraud Office (OLAF). The operation, led by the EPPO’s office in Brussels, also counted on the support of the Belgian Federal and Local Police:

Belgian Federal Judicial Police:

The Central Office for Fight Against Organised Economic and Financial Crime (OCDEFO-CDGEFID)

The Central Office against Corruption (OCRC-CDBC)

Federal Computer Crime Unit (FCCU)

Federal Judicial Police (Police Judiciaire Fédérale de Liège)

Intervention Service (Corps d’intervention de Liège)

Federal Administrative Police: Canine support

Local police forces of Grâce Hollogne-Awans, Basse-Meuse and Fléron.

The operation also counted on the help of Europol, the Belgian Customs authorities, the Special Tax Investigation division of the Belgian Ministry of Finance, a mixed investigation team MOTEM and the Central Office for Seizures and Confiscations (OCSV-COIV).

* An earlier version of this press release stated that the estimated damages in evaded tax amounted to €303 million. This amount was modified to €310 million, to include also the estimated damages in custom duties (€303 million in VAT plus €6.6 million in custom duties).

EN

EN