UK-PVA Service

-

Global Logistics Solutions ——Explore Matic Express's Procurement Services

In today's competitive business environment, companies need efficient logistics solutions to maintain a competitive edge. As a leader in the international logistics and freight forwarding industry, Matic Express leverages its professional team and extensive experience to provide one-stop logistics procurement services, helping clients achieve smooth global business operations.

Supplier Selection and Management: Ensuring Excellence in Every Step

Successful logistics procurement begins with the selection and management of high-quality suppliers. Matic Express ensures collaboration with reputable and high-quality suppliers worldwide through a rigorous screening process. Our team thoroughly understands each supplier's strengths and potential, providing clients with the most suitable options and establishing long-term, stable partnerships. Here are the three key steps in our supplier selection and management process:

01 Rigorous Screening and Evaluation: Finding the Best Partners

We employ a rigorous selection process to comprehensively evaluate potential suppliers. This includes examining various aspects such as their service quality, industry reputation, financial status, operational capability, and compliance. Through this multi-dimensional assessment, we can identify suppliers that meet our high standards, ensuring the provision of high-quality and reliable logistics services for our clients.

02 Long-term Collaboration and Relationship Management: Building a Stable Supply Chain

Once suppliers are selected, we focus on establishing long-term and stable partnerships with them. Through continuous communication and collaboration, we maintain close contact with our suppliers to ensure their services consistently meet our requirements and customer expectations. We conduct regular performance evaluations and provide feedback to encourage suppliers to continuously improve and enhance service quality.

03 Continuous Monitoring and Optimization: Maintaining Efficient Operations

To ensure efficient supply chain operations, we continuously monitor and optimize our suppliers. This includes real-time tracking of supplier performance, promptly identifying and resolving issues, and ensuring smooth operation at every stage of the goods transportation process. Through data analysis and performance evaluations, we continuously refine our supplier management strategies, enhancing the efficiency and reliability of the entire supply chain.

Customized Logistics Solutions: Tailoring Your Transportation Plan

Personalized Assessment and Needs Analysis

Our expert team will first conduct a detailed assessment of your logistics needs, analyzing the characteristics of your cargo, destination, and time requirements. By gaining an in-depth understanding of your business needs, we can develop a transportation plan that best suits your specific situation, ensuring the efficiency and suitability of the logistics solution.

Diversified Transportation Mode Selection

Based on your needs, we offer a combination of various transportation methods, including sea, air, and land. Whether it's sea freight for bulk cargo or air freight for urgent shipments, we can select the most suitable transportation method for you to maximize cost efficiency and optimize delivery time.

Cost Optimization and Risk Management: Ensuring Efficient and Secure Logistics Processes

Resource Integration and Cost Control

By integrating global logistics resources, Matic Express can effectively reduce transportation costs. We collaborate with multiple high-quality suppliers, leveraging bulk transportation and resource sharing to decrease individual shipping expenses. Additionally, through optimizing transportation routes and methods, we further reduce logistics expenses, enhancing cost-effectiveness for businesses.

Comprehensive Risk Assessment and Emergency Response Plan

We focus on risk management in the logistics process, developing detailed emergency plans for various potential risk factors, including natural disasters, transportation delays, and cargo damage. We conduct comprehensive risk assessments before transportation and prepare corresponding emergency measures to ensure swift and effective problem resolution in case of emergencies, safeguarding cargo security.

Real-time Monitoring and Information Transparency

Matic Express has implemented an advanced logistics management system that monitors the status of goods in real-time, providing clients with transparent and reliable services. Through our online platform, client can track the progress of their shipments at any time, staying informed about the latest updates, thus enhancing the convenience and efficiency of logistics management. This not only strengthens client trust but also helps us identify and address potential issues promptly, reducing logistics risks.

Advanced Logistics Technology

In rapidly developing technological landscape, the logistics industry is also constantly innovating. Matic Express has introduced an advanced logistics management system, which monitors the status of goods in real-time, providing customers with transparent and reliable services. Through our online platform, customers can inquire about the progress of their shipments at any time, keeping them informed of the latest updates, thus enhancing the convenience and efficiency of logistics management.

Global Network and Local Services

As international logistics experts, Matic Express possesses an extensive network and resources worldwide, while also emphasizing localized services. Regardless of where your business is located, we can provide professional and attentive services. Our team is familiar with logistics regulations and operational procedures in various regions, ensuring smooth customs clearance and prompt delivery of goods.

Summary

Matic Express is committed to providing clients with excellent logistics procurement services, offering efficient, economical, and secure solutions to help businesses succeed in the global market. We understand that high-quality logistics services are the cornerstone of business development. Therefore, we continuously optimize service quality, work hand in hand with customers, and create a brilliant future together.

Choose Matic Express to be your trusted logistics partner and together, let's embrace the endless opportunities brought by globalization!

-

Professional Services Include

Extensive Coverage: Provide land transportation services covering all provinces and cities domestically as well as neighboring countries, including road and rail transport, ensuring timely delivery of goods to their destination.

Efficient Transport: Equipped with a professional logistics team and modern transportation tools, offering efficient and reliable land transportation services suitable for short-distance and regional transport.

Variety of Services: Offer various land transportation services, including door-to-door delivery, and develop the optimal transportation plan based on client needs to ensure the safe and timely delivery of goods.

-

Professional Services Include

Express Delivery: Provide air freight services covering major airports worldwide, suitable for time-sensitive cargo, ensuring fast and secure delivery.

High Security: Utilize high-standard security measures to ensure the safety of goods during transportation, reducing the risk of damage and loss.

Flexible Scheduling: Offer regular flights and charter services, flexibly scheduled according toclient needs to meet various urgent cargo transportation requirements.

-

Professional Services Include

Global Shipping Network: Provide ocean freight services covering major ports worldwide, including container shipping, bulk cargo shipping, and roll-on/roll-off shipping, to meet various cargo needs.

Cost-Effective: Compared to other transportation methods, ocean freight is more cost-effective, suitable for bulk commodities and long-distance transportation, helping clients save on logistics costs.

Flexible Solutions: Offer various ocean freight solutions such as door-to-door and port-to-port services, flexibly addressing different logistics needs ofclients.

-

Professional Services Include

Strategic Locations: Operate three overseas warehouses in the United States and collaborate closely with warehouses in other countries to ensure global coverage of warehousing needs.

Localized Services: Provide localized warehousing and distribution services to reduce time and costs associated with international transportation, thereby improving logistics efficiency.

Comprehensive Services: Offer integrated services including warehousing, sorting, packaging, labeling, and more, simplifying clients' supply chain management.

-

Professional Services Include

Extensive Coverage: Modern warehouses are established in major cities across China such as Shenzhen, Guangzhou, Shanghai, Yiwu, Ningbo, Dalian, providing extensive coverage.

Flexible Storage: Offer options for short-term and long-term storage to meet various warehousing needs.

Efficient Management: Provide comprehensive services including warehousing, sorting, packaging, labeling, using advanced warehouse management systems to ensure precise inventorying, inbound and outbound operations, and inventory management, enhancing warehouse efficiency.

-

Professional Services Include

Quality Control: Strictly control product quality throughout the procurement process to ensure goods meet client quality standards and requirements.

On-Site Inspection: Arrange professional personnel to conduct on-site inspections during supplier production to ensure the production process and product quality meet standards.

Third-Party Testing: Arrange third-party inspection agencies as needed to conduct quality testing, ensuring product quality meets international standards and safeguardingclient interests.

-

Professional Services Include

Order Management: Develop detailed order plans based on customer procurement needs, ensuring an efficient and smooth procurement process.

Order Tracking: Monitor order status in real-time, ensuring suppliers produce and deliver on time, promptly addressing any issues that may arise in the order process to ensure timely delivery.

Delivery Coordination: Coordinate suppliers, logistics, and warehousing to ensure goods are dispatched smoothly from suppliers and arrive at the designated destination on time.

-

Professional Services Include

Supplier Selection: Select high-quality suppliers that meet quality and price standards based on client needs, ensuring the reliability and stability of the supply chain.

Supplier Evaluation and Audit: Regularly evaluate and audit suppliers to ensure their production capacity, quality control, and delivery capability, safeguarding product quality and on-time delivery.

Long-term Cooperation and Maintenance: Establish and maintain long-term cooperative relationships with high-quality suppliers. Through continuous communication and collaboration, ensure a stable supply chain and high-quality service.

-

Amazon is introducing a stricter appointment-based delivery policy. How can sellers ensure timely warehouse entry?

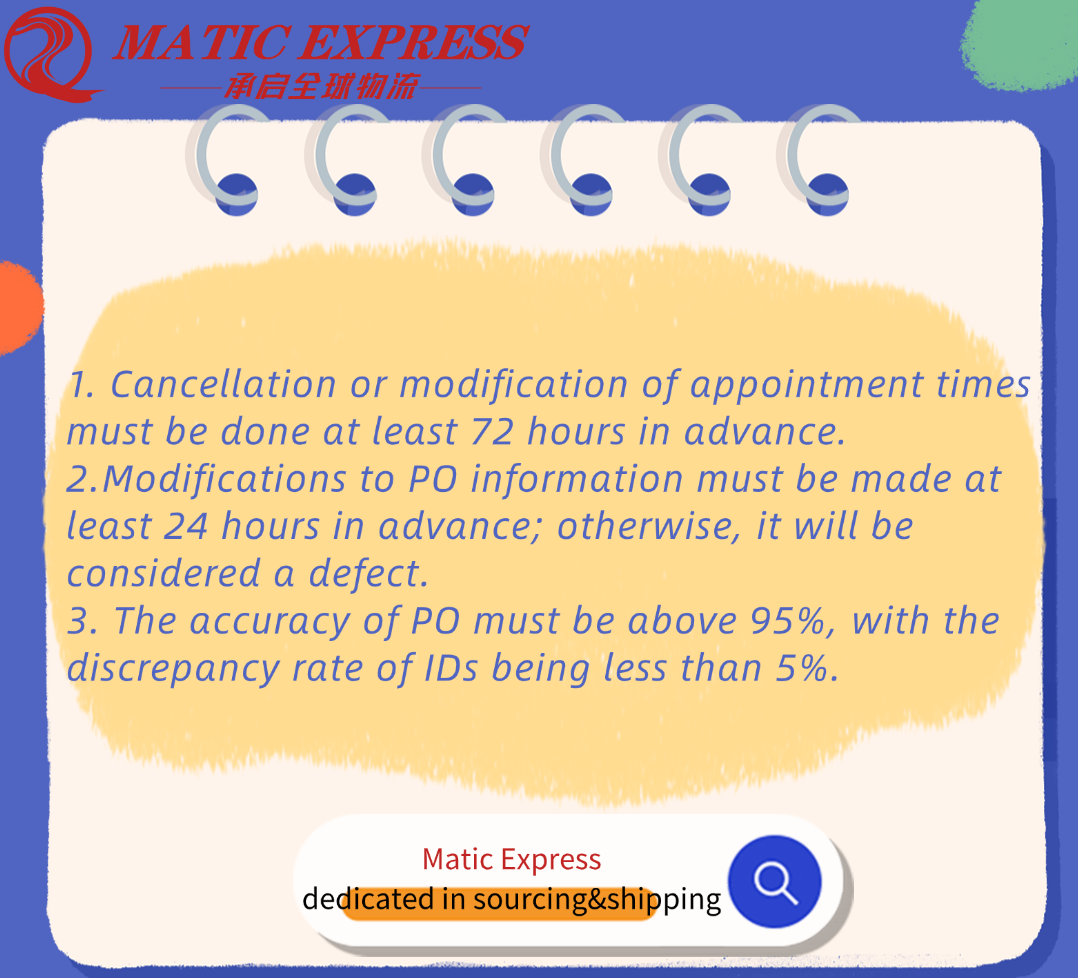

In May of last year, Amazon introduced new regulations regarding PO (Purchase Order) numbers, which had a significant impact on the efficiency of end-of-line goods entering warehouses. Let's review the three main requirements emphasized in that policy:

Recently, there has been news that Amazon will implement new FBA policies starting from July 1st. These new policies mainly focus on "appointment PO accuracy," further standardizing FBA operational standards and improving overall logistics efficiency.

The new regulations mainly include three independent defect rate calculation methods:

1. PO accuracy for truck deliveries;

2. Rescheduling appointments;

3. Missing appointments due to NCNS (No-Call, No-Show).

*PO Number: This refers to the "Shipment Tracking Number," which is the appointment number for truck deliveries into Amazon warehouses.

PO Accuracy: This refers to the comparison between the number of POs entered by the carrier during the appointment and the number of POs received by Amazon.

No-Call-No-Show (NCNS): This refers to failing to arrive for an appointment or arriving later than the scheduledtime.

As we all know, PO numbers are crucial as they determine whether goods can be smoothly received and shelved in the warehouse. Defect rates and accuracy are directly related to the appointment account.

It is understood that the calculation of appointment PO accuracy has restarted. If any of the three defect rates reach a certain threshold, Amazon will directly close the appointment delivery account and delete all future appointments.

To avoid subsequent impacts on deliveries, starting from July 1st:

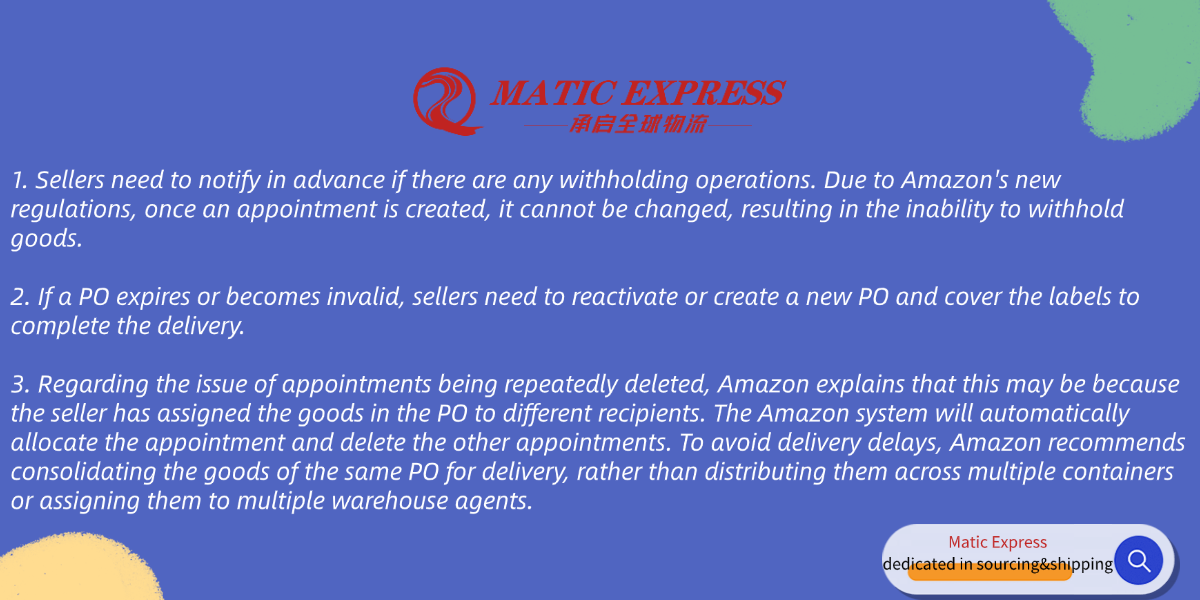

Amazon's latest policy update not only raises higher demands on end service providers' resource allocation and control capabilities but also means that during peak seasons, Amazon has increased its shipping requirements for sellers. It is recommended:

1. For goods that have not yet been shipped:sellers should confirm the accuracy and validity of their PO before placing an order.

2.For goods in transit:1. If there are issues with PO invalidation, make sure to apply for reactivation. If the goods cannot be reactivated, they will not be able to enter the warehouse and will temporarily remain in the Lianyu overseas warehouse. Sellers will need to create a new warehouse order before proceeding with subsequent tasks.

2.Additionally, sellers need to check whether the Amazon warehouse corresponding to the PO matches the actual shipping Amazon warehouse. If the Amazon warehouse in the PO does not match the actual receiving warehouse, it is necessary to verify and accurately create a new warehouse order before proceeding with subsequent tasks.

In short, as Amazon Prime Day approaches, sellers should be especially diligent in logistics and shipping management. Ensure that before placing orders, the PO information for goods is accurate, error-free, and valid.

At the same time, ensure that all goods information matches the data in the Amazon system to ensure the goods arrive at Amazon FBA warehouses on schedule, thereby avoiding logistics delays and additional costs.

-

Customized International Logistics Solutions: The Success St

Client Case Study 01

International Logistics Solution for ABC Manufacturing Compan

International Logistics Solution for ABC Manufacturing Company

Issue 01: ABC Manufacturing Company

Due to the confidentiality requirements of client information, we will use code names instead of real names when sharing case studies to ensure full privacy protection.

In this week's client and case study share, we will provide a detailed overview of a successful collaboration with ABC Manufacturing Company. We will showcase how we delivered customized international logistics solutions to meet their unique needs and achieve significant results.

01Client Requirements

ABC Manufacturing Company is a rapidly growing multinational enterprise that produces high-tech electronic products, facing complex international logistics challenges. As their business expands swiftly, ABC Company needs to import raw materials from multiple international suppliers and export finished products to various global markets. Their specific requirements include:

1. Multi-channel logistics management: Coordination of sea, air, and land transportation to ensure seamless integration of all segments.

2. Timely delivery: Due to tight production cycles, the logistics solution must ensure fast and on-time delivery.

3. Cost control: Maximizing efficiency while minimizing logistics costs.

4. Reliability: Ensuring the safety of goods during transportation to prevent damage and loss.

02 Solution

In response to ABC Company's requirements, we designed and implemented a comprehensive logistics solution that included the following key steps:

In response to ABC Company's requirements, we designed and implemented a comprehensive logistics solution that included the following key steps:Customized Logistics Planning: We began with a detailed needs analysis in collaboration with ABC Company's management team and developed a comprehensive logistics plan covering sea, air, and land transportation.

Based on their production and sales schedules, we identified the optimal transportation routes and timelines, repeatedly ensuring the best flow for each batch of goods.

Multimodal Transportation Coordination: To ensure efficiency and flexibility in transportation, we combined sea and air transport. For scheduled shipments, we prioritized cost-effective sea transport, while for urgent shipments, we used air transport to ensure timely delivery. Specifically, we transported 70% of the goods by sea and used air transport for the remaining 30% to handle urgent orders.

End-to-End Tracking and Management: Using an advanced logistics management system, we provided real-time tracking and management of all transportation stages. Through GPS tracking and RFID technology, we were able to monitor the location and status of the goods in real-time, ensuring control over every step of the journey. Additionally, we established a dedicated customer service team to handle and resolve any issues that might arise during transportation.

Optimized Warehousing and Distribution: We set up three transit warehouses at strategic locations and optimized the distribution routes. By strategically arranging warehouse locations and transportation paths, we effectively reduced transportation time and costs. For example, we established warehouses in Shanghai, Los Angeles, and Frankfurt to ensure rapid distribution of goods to various destinations.

03 Final Outcome

After implementing our logistics solution, ABC Company achieved significant results in multiple aspects.

01Improved logistics efficiency

Through multimodal transportation and end-to-end tracking, ABC Company reduced its delivery time by 35%. Specific data indicates that the transportation time, originally 30 days, now only takes 20 days.

02 Reduced logistics costs

The optimized logistics solution helped ABC Company reduce overall logistics costs by 25%. This includes a reduction of approximately 15% in transportation costs through the judicious combination of sea and air transport, as well as a 10% cost savings from optimized warehousing and distribution.

03 Increased customer satisfaction

Due to the timely and secure delivery, customer satisfaction at ABC Company has significantly improved. According to surveys, customer satisfaction has increased by 20 percentage points, rising from the previous 78% to 98%.

The efficient logistics solution has enabled ABC Company to respond more rapidly to market demands, further solidifying its competitive advantage in the international market. Data indicates that its market share increased by 10% within six months of implementing the solution.

Through our successful collaboration with ABC Manufacturing Company, we have demonstrated the importance and immense potential of customized international logistics solutions. We remain committed to providing efficient and reliable logistics services to our clients, helping them achieve greater success in the global market.

Stay tuned for more success stories and logistics solutions. Follow us to learn more.

Website|www.maticexpress.com

WhatsApp|+86 191 1883 5395

Client Service Team|MaticExpressGlobal

Email|[email protected]

Facebook Page|www.facebook.com/MaticExpressSZ/

-------------------------

-

Type of Transportation

Introduction

In the globalized business environment, choosing the right logistics transportation mode is critical to a company's success.

As a professional international freight forwarding company, we are dedicated to providing our clients with comprehensive and efficient logistics solutions. This article will detail the characteristics, advantages, and applicable scope of the three main transportation modes—ocean freight, air freight, and land transportation—to help you make informed decisions in the complex field of international logistics.

Ocean Freight Transportation/ 01

@Characteristics and advantages

Large Capacity Transportation: Maritime transportation can carry a large volume of cargo. A 20-foot container (20GP) can accommodate approximately 17.5 tons of cargo, a 40-foot container (40GP) about 22 tons, and a 40-foot high cube container (40HQ) up to 26 tons.

This makes maritime shipping an ideal choice for bulk commodities and large-scale trade.

@Cost-effective

Sea transportation has a lower unit transportation cost, making it particularly suitable for long-distance transportation.

According to the International Federation of Freight Forwarders Associations (FIATA), sea freight costs are typically 40%-60% lower than air freight, making it the preferred choice for companies looking to save on transportation costs.

@Diverse forms of transportation

Container Shipping: Suitable for most goods, providing high levels of security and standardized transportation conditions.

Bulk Shipping: Suitable for irregular, large-volume goods such as ores, coal, and grains, but can also be used for small-volume goods, making it the most cost-effective choice when meeting shipping requirements.

Roll-on/Roll-off (RoRo) Shipping: Suitable for the transportation of vehicles and heavy machinery, providing convenient loading and unloading services.

Applicability:

International Long-Distance Transportation:

Particularly suitable for large-scale intercontinental cargo transportation.

Bulk Commodities:

Such as minerals, agricultural products, and chemicals.

Heavy Machinery and Equipment:

Large goods requiring a stable transportation environment.

Timeliness of Sea Transportation:

Sea transport has relatively low timeliness, typically taking 15-20 days from China to the west coast of the United States and 25-30 days to European ports.

Therefore, sea transportation is suitable for non-urgent cargo transportation.

Air Transportation / 02

@Characteristics and advantages

Fast Transportation: Air transportation is the fastest international transportation mode, suitable for goods with high time-sensitivity requirements. Typically, transportation from Asia to North America or Europe can be completed within 8-12 days, significantly shortening delivery times.

@Global Coverage

The airfreight network covers major cities around the world, providing a wide range of transportation options and flexibility for trade activities.

@Scope of application

High-value goods: such as electronic products, luxury goods, medicines, etc. Air transportation can ensure their fast and safe arrival.

Urgent orders: goods that need to be delivered quickly.

Fresh products: such as seafood, fruits and other time-sensitive goods.

@Timeliness of air transportation

Airfreight is extremely time-sensitive, and usually reaches its destination within 8-12 days from China to major cities in North America or Europe. However, the time for ground handling, customs clearance, etc. needs to be taken into account.

Land Transportation / 03

Characteristics and advantages

High Flexibility:

Ground transportation offers “door-to-door” service that is flexible enough to respond to a variety of transportation needs, especially for regional transportation between domestic and neighboring countries. Clients don't have to deal with cumbersome operations, we will arrange and ensure the smooth delivery of goods.

Affordable:

Ground transportation is an affordable and efficient choice for short-distance and regional transportation. According to China Federation of Logistics and Purchasing (CFLP), domestic land transportation takes up more than 70% of the total logistics transportation, providing reliable cargo delivery services.

The means of transportation are diverse:

Road transportation: suitable for most goods, providing flexible transportation services.

Railroad transportation:

Suitable for long-distance transportation of large quantities of goods, providing a stable transportation environment.

Scope of application:

Regional international transportation:

For example, transportation from China to Southeast Asian countries.

Multi-frequency small-volume cargo:

Such as FMCG, daily necessities, etc.

Timeliness of Land Transportation

The timeliness of land transportation is between sea transportation and air transportation. Domestic transportation is usually completed within 2-3 days,

and cross-border transportation varies according to distance and clients clearance.

【Through the detailed analysis of the three main modes of transportation, namely sea freight, air freight and land freight, we see that each mode of transportation has its unique advantages and scope of application. As a professional international logistics forwarding company, we are committed to providing the most suitable transportation solutions according to the specific needs of our clients to ensure that your goods arrive at their destination safely and on time.

By choosing us, you will enjoy one-stop logistics services and full support from our professional team. We look forward to working with you to develop a broader international market and escort your business success!

Please feel free to contact us if you have any questions or need further assistance.】

Contact Us

Company Page|www.maticexpress.com

WhatsApp|+86 191 1883 5395

Wechat|MaticExpressGlobal

Email|[email protected]

Facebook Page|www.facebook.com/MaticExpressSZ/

-------------------------

-

Breaking: Several shipping companies, declaring "VL NO CONTACT ISRAEL," safely navigated and even reversed course in the Bab al-Mandab Strait.

Some vessels not only passed safely but also traced an enchanting trajectory.

Is it currently safe to navigate through the Bab al-Mandab Strait? The escalating tension between Houthis and the United States, the UK, and other countries, coupled with the current polarized situation in the passage of commercial ships through the Red Sea and the Bab al-Mandab , raises the question of whether it is safe for navigation. Matic Express, through continuous data tracking, provides an analysis for everyone today!

On January 7th, local time, Mohamed Ali al-Houthi, a high-ranking leader of the Houthis, stated that as long as vessels declare “(VL NO CONTACT ISRAEL),” they will not be attacked. Subsequently, the Houthis provided detailed guidelines for the safe passage of commercial ships through the Bab al-Mandab Strait, citing specific examples. Read more:Breaking News! Red Sea Crisis: Houthis Reveal Crucial Turning Point

According to the latest tracking data: on the morning of January 11th, at least 8 vessels have safely passed or are planning to pass through the Red Sea and the Bab al-Mandab Strait after declaring “VL NO CONTACT ISRAEL” in their ship documentation, in accordance with the requirements of the Houthis.

▲ Vessels marked with “VL NO CONTACT ISRAEL” In addition, three ships successfully navigated through the Strait.

1、AFRICA SUN(IMO 9359105)

2、PALERMO ( IMO 9168207)

3、XIN HE LU 1( IMO:9139907)

Data shows that the container ship “KOTA HAKIM” under PIL successfully navigated through the Bab al-Mandab Strait in just one week, even achieving a magical return journey between ports in the region, which is truly astonishing!

▲ The vessel Kota Hakim reverses course in the Bab al-Mandab Strait. The declaration by Houthis, stating “VL NO CONTACT ISRAEL,” could potentially result in the shipping market being divided into two categories: companies that can navigate through the Bab al-Mandab Strait and those that cannot. Neutral or regional shipping companies might gain an advantage in safely passing through the Strait, while some European and American companies may need to either attempt passage with AIS closed under U.S. military escort or take a detour around the Cape of Good Hope.

In the current tense geopolitical environment, the passage situation through the Bab al-Mandab Strait is being closely monitored.

As always, Matic Express pay attention to price trends and news dynamics, aiming to provide clients with more accurate information and better services. We appreciate your attention and trust in Matic’s services.

Click to Website-MaticExpress -

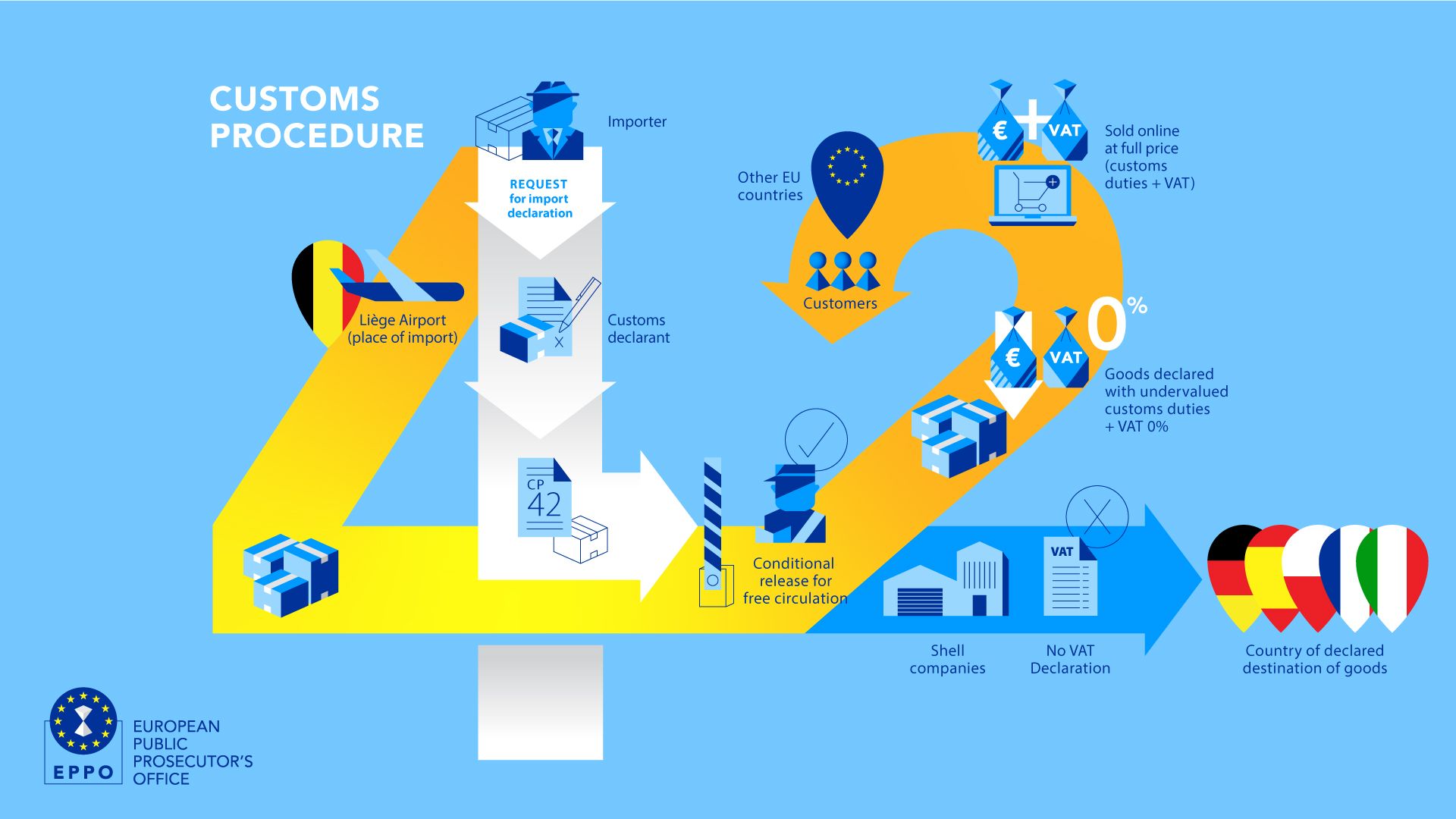

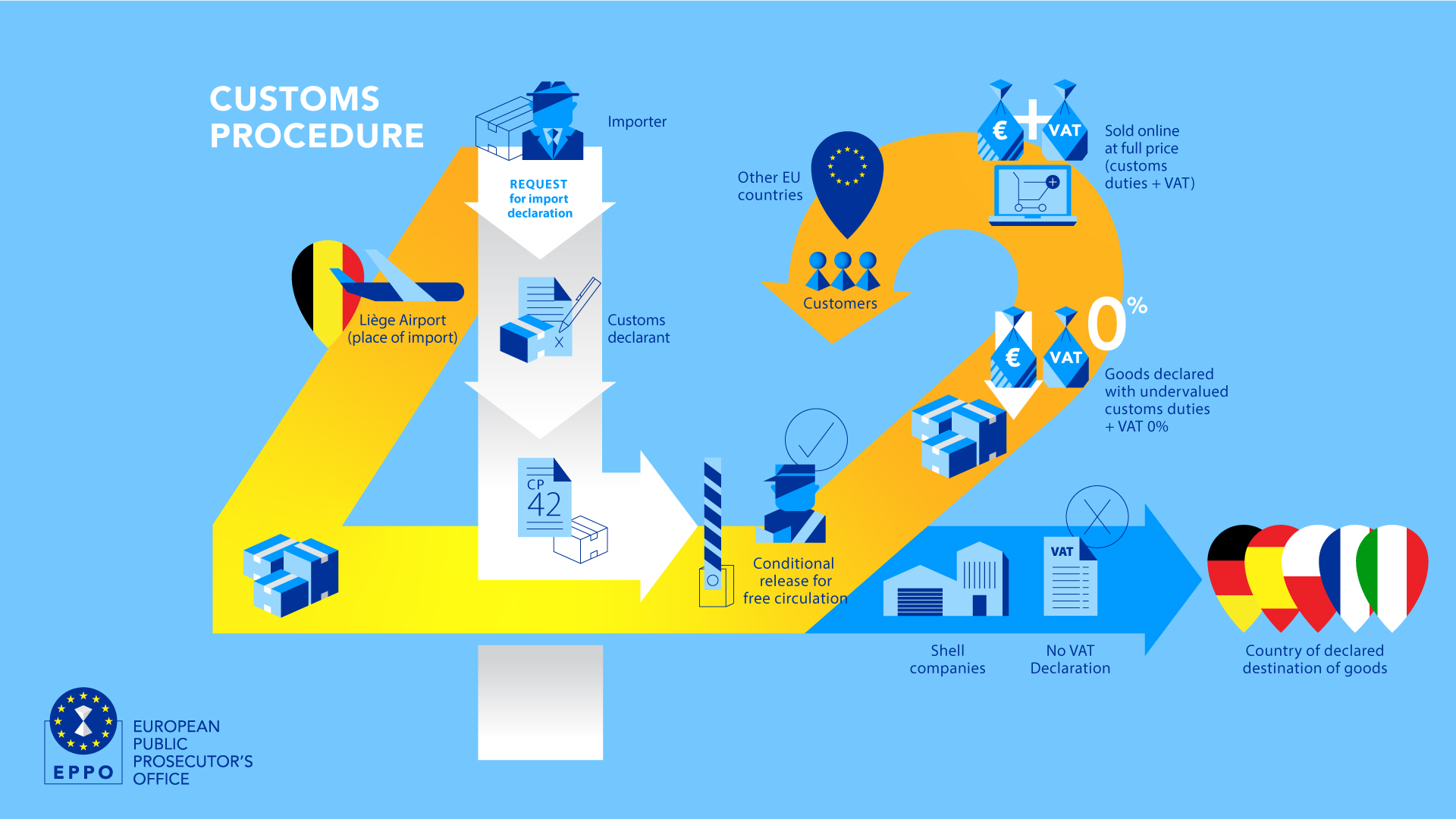

CP42 Fraud: EPPO dismantles customs fraud ring operating at Liège Airport – €310 million in estimated damages

News from @European Public Prosecutor's Office - EPPO

The European Public Prosecutor’s Office (EPPO) today, 28 March 2023, carried out ten searches in several locations in Belgium, including at Liège Airport, and arrested four suspects, during an operation against a customs fraud ring believed to have caused damages of up to €310 million in evaded tax and custom duties.

During the operation, carried out with the support of Europol, the Belgium Customs and VAT Authorities and several branches of the Belgian Police, officers raided storage premises and offices at Liège Airport and in Zeebrugge, as well as private houses of the suspects in Ans (Alleur), Liège and Visé, seizing evidence and assets.

On the radar of the EPPO’s European Delegated Prosecutors in Brussels in this investigation, code-named ‘Silk Road’, are Chinese exporters suspected of having put in place a complex system to evade the payment of VAT on imported goods, using three Belgian private customs agencies and a number of fake companies in several EU Member States.

According to the investigation, the Belgian companies, acting as customs and VAT reliable representatives of the Chinese exporters, declared that the goods entering through Liège Airport – electronic equipment, toys and a myriad of accessories – were destined for other Member States, in order to benefit from a VAT import exemption based on the EU’s ‘Customs Procedure 42’ (CP42).

What is CP42 fraud?

Customs Procedure 42 exempts importers from paying VAT in the country of importation, if the imported goods are subsequently transported to another EU Member State. Under this procedure, created to simplify cross-border trade, VAT is exempted in the country of importation, when the goods are acquired in the final Member State of destination.

To benefit from this exemption, the Chinese exporters used private customs agencies/VAT reliable representatives in Belgium, who would declare that the final destination of the goods was in other Member States. In order to do so, they are believed to have used shell companies located in France, Germany, Hungary, Italy, Poland and Spain, using fake invoices and falsified transport documents. In some cases, they allegedly used the names of real companies, which were unaware that their VAT numbers and identities had been stolen.

However, in reality, the shell companies would not receive the goods, which were actually supplied to real companies established in other Member States, or sold to final consumers via online marketplaces in several countries. The purpose of these shell companies was to divert the attention of inspectors, creating a fake commercial chain and making it more difficult to carry out checks.

The goods would ultimately be sold to the final consumer, who would pay full price for the products, including VAT. However, according to the investigation, the VAT paid by the final consumer was never declared nor paid to any tax administration by the alleged criminal organisation, and was instead kept by the seller. This allowed for the goods to be sold at massive profits, while defrauding tax collection agencies of customs duties and VAT.

It is estimated that the activities under investigation have, between 2019 to 2022, caused damages of at least €303 million in evaded VAT and €6.6 million in custom duties.

The crimes under investigation include forgery, customs and VAT fraud, money laundering and participation in a criminal organisation.

At the EPPO’s request, the Belgian investigative judge issued a seizure order for computers and electronic devices (for gathering of evidence), as well as any asset with a value higher than €1000.

Among the suspects arrested today are two directors, one accountant and another employee of the Belgian companies under investigation.

Today’s operation also allowed for the freezing of a dozen bank accounts and the seizure of four cars (including brands like Audi, BMW and Mini Cooper).

Cooperation with partners

The facts under examination were brought to the attention of the EPPO by the Belgian Customs authorities and investigations by the European Anti-Fraud Office (OLAF). The operation, led by the EPPO’s office in Brussels, also counted on the support of the Belgian Federal and Local Police:

Belgian Federal Judicial Police:

The Central Office for Fight Against Organised Economic and Financial Crime (OCDEFO-CDGEFID)

The Central Office against Corruption (OCRC-CDBC)

Federal Computer Crime Unit (FCCU)

Federal Judicial Police (Police Judiciaire Fédérale de Liège)

Intervention Service (Corps d’intervention de Liège)

Federal Administrative Police: Canine support

Local police forces of Grâce Hollogne-Awans, Basse-Meuse and Fléron.

The operation also counted on the help of Europol, the Belgian Customs authorities, the Special Tax Investigation division of the Belgian Ministry of Finance, a mixed investigation team MOTEM and the Central Office for Seizures and Confiscations (OCSV-COIV).

* An earlier version of this press release stated that the estimated damages in evaded tax amounted to €303 million. This amount was modified to €310 million, to include also the estimated damages in custom duties (€303 million in VAT plus €6.6 million in custom duties).

-

international logistic company--Matic Express

FBA Service

Fulfillment By Amazon FBA is a service provided by Amazon that provides storage, packaging, and shipping assistance to sellers. This takes the burden off of sellers and grants them more flexibility in their selling practices.

Matic Express Logistic provides FBA service for our customers,it is easy to make your shipping easier,best wish that your product can be hot selling in Amazon.

Our Advantages

Our FBA services covers pick-up of your inventory, short term storage, outer carton prep check and labeling to shipping to Amazon FBA centers across the USA, Canada,Australia,France,United Kingdom and Europe countries. We also offer additional seller service options that includes supplier sourcing, background checks, translations, product check,product photography, repacking, and more.

We know all there is to know about FBA logistics to Amazon warehouses because it's our specialty.

-

Air freight --door to door with DDP & DDU

Air freight --door to door with DDP & DDU

Air transportation is one of the core businesses of Matic Express, and it has established close partnerships with many domestic and foreign airlines. It has formed a trend of covering the East China and North China with the South China as the center. At present, Sinotech Logistics has established airport service centers including transit warehouses in Shenzhen, Guangzhou, Hong Kong, Shanghai, Yiwu, Ningbo and other major domestic cities, providing "one-stop" services for receiving, tallying, measuring, and customs declaration.

-

International shipment--Sea shipping FCL & LCL

International shipment--Sea shippingFCL & LCL

Centered in Shenzhen, Guangzhou, Hong Kong and the hinterland of the Pearl River Delta, Matic Express Logistics radiates to Shenzhen, Yiwu, Shanghai, Ningbo, Qingdao,Tianjin and Dalian coastal ports, specializing in contracting FCL container transportation agency business. We have established long-term partnerships with large shipping companies such as APL, COSCO, CSAV, HANJIN, PIL, and YML. With the help of a global agency network.

We can provide import and export transportation services for FCL, bulk cargo, and consolidated shipping. Through the supporting customs declaration, inspection declaration, insurance, terminal cargo handling, trailer, taxation, warehousing and other services, it can realize door-to-door or point-to-point transportation on a global scale, and can provide consolidation or distribution services.

-

Provide you freight service of door to door shipping

Provide you freight service of door to door shipping

Door to Door Shipping, whatever you need sea shipping,air freight or railway express and international express,wherever the delivery address is USA ,Canada, Australia, United Kingdom, Netherlands, Germany, Italy, United Arab Emirates, France, Spain, Belgium ,Japan, Czech Republic, Poland, Luxembourg, Denmark, Austria, Estonia, Slovakia, Slovenia, Hungary, Finland, Greece, Sweden ,Lithuania, Portugal, Bulgaria, Latvia, Ireland, Belgium, if you want to look for logistic company to deliver goods, we make door to door service for you.Door to door service includes two ways DDP & DDU freights.

Door to door DDU delivery service countries, USA ,Canada, Australia, United Kingdom, Netherlands, Germany, Italy, United Arab Emirates, France, Spain, Belgium ,Japan, Czech Republic, Poland, Luxembourg, Denmark, Austria, Estonia, Slovakia, Slovenia, Hungary, Finland, Greece, Sweden ,Lithuania, Portugal, Bulgaria, Latvia, Ireland, Belgium Door-to-door is a easy and very convenient way to deliver goods from China to other countries .

Customers don't need to worry about too much transports. The logistic company will deliver your goods from the factory in China to your doorstep. You can use this time to create more and larger business opportunities, and the freight forwarder will find ways to save you costs according to your choice shipping ways, such as unnecessary warehousing costs and lower logistics costs.

-

International shipping forwarder in Shengzhen China

Every multiple-shipment project may present logistical process complexities, so our diverse international Logistics Division provides customized freight solutions exclusively for our customers and their specific transportation requirements. As your single shipping resource, we coordinate all cargo delivery, information needs and carrier requirements into a collective solution.

Imports

Matic Express Logistic, will coordinate before your vendor is ready to ship, assisting you with making delivery dates to your clients by providing accurate readiness information from overseas. As a customs broker, we can clear your cargo before it arrives into the USA for final delivery.

Our overseas office will coordinate multiple vendor shipments onto a single house bill or a single consolidation based on your banking requirements. Daily pre-advices from our agents globally provide you with the expected arrival information, which our local office updates with any delays.

Imports department in Matic Express handles air, ocean, bulk, consolidation & customs clearance for all of your import needs. We are a licensed customs broker that can clear cargo in every port in the USA.

Exports

Our staff at Matic Express, will provide a quotation for your exports overseas. We utilize a variety of carriers specializing in specific trade lanes, in order to offer the best available market price to your destinations.

When goods are ready for shipping, we will guide you through the necessary export documentation required, and book arrangements for pickup for LCL or a full container. Pre-alert details will be faxed upon confirmation from the carrier that the goods have been received and are departed. We courier your original documents to our overseas correspondent for coordination with your customer.

We are also able to coordinate returned goods shipments, by first obtaining authorization from the vendor overseas prior to shipping. The original import documentation, temporary export documentation, carnets, etc. will be recommended depending on the situation. Booking and shipping details will be effected with your office and coordinated with our overseas office for clearance and delivery to your customer efficiently.

-

an international logistic forwarder--Matic Express in Shenzhen China

Matic Express was established in 2007 in Shenzhen, China, specializing in international Logistics services. Our services include: air freight, sea shipping, courier service, drop shipping,door-to-door shipping, shipping to Amazon, China and USA Warehouse, Pre-delivery Inspection Services. In addition, we have opened logistics services in many countries, Provide services in USA, Canada, Australia, United Kingdom, Netherlands, Germany, Italy, United Arab Emirates, France, Spain, Belgium, Japan, Czech Republic, Poland, Luxembourg, Denmark, Austria, Estonia, Slovakia, Slovenia, Hungary, Finland, Greece, Sweden ,Lithuania, Portugal, Bulgaria, Latvia, Ireland, Belgium.

Matic Express Logistic has long term cooperation with DHL, UPS, FEXDE, TNT, MAERSK, MSC, EVERGREEN, MATSON, COSCO, OOCL, EMC and other shipping companies. The service scope covers almost the whole world.

EN

EN