Customs clearance is crucial when importing goods, whether they are from China or another nation like Courier services China to Finland. Before shipping your goods, there are a number of things to take into account.

The price of shipping will vary depending on a number of factors, including whether you are shipping from China to Finland for business or pleasure. The type of shipping service used and the weight of your cargo affect the cost.

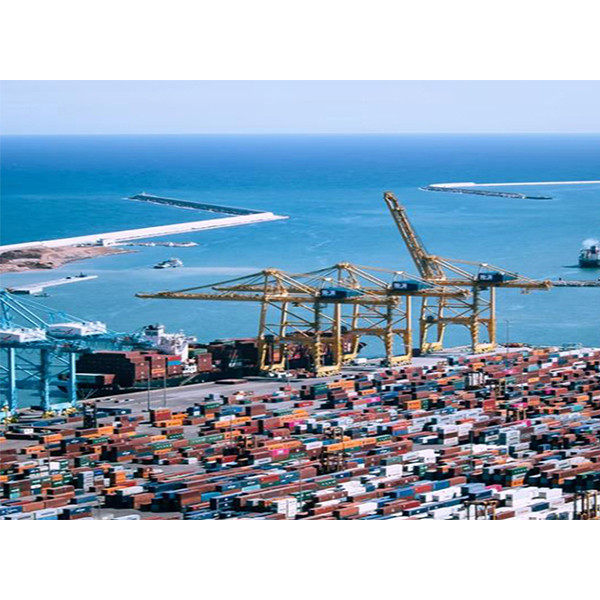

LCL (less than container load) shipping is the best option for smaller shipments. This is because the container need not be filled to the brim. Instead, you could pack it on more compact Euro pallets. Consider shipping your heavier load by full container load if you have the option.

Smaller shipments can also benefit from air shipping or sea shipping. There are many benefits, including quicker delivery times. Additionally, you can benefit from free pick-up and delivery. However, the cost of air freight is typically higher than that of sea freight. Additionally, import taxes will be due.

LCL shipping is typically less expensive than sea freight. There are, however, a number of things to think about. Cost, transit time, the kind of goods shipped, and the possibility of additional fees are a few common deciding factors. Additionally, case-specific elements may have an impact on the final cost.

The actual volume of a shipment in a shared shipping container determines the cost of LCL shipping. The height and width of the carton are then multiplied by the volume weight. A 50 kg shipment, for instance, has a 160 kg volume weight.

It takes more time for an LCL shipment to get to its destination. It can potentially be damaged more easily and requires more handling. Also possible are additional storage costs. Furthermore, there are more people working on LCL shipments. Additional errors and unforeseen charges may result from this customs clearance.

It is critical to have the appropriate documentation to ensure a smooth transaction, whether you want to export to Finland or send goods from China there. One of the most crucial records in cross-border commerce is the commercial invoice thats why it is important to have trusted Customs Clearance.

The price, quantity, and value of the goods being sent are all specified in this legally binding document. Customs officials in the nation of the buyer use it to compute import taxes. Taxes are also computed using the cost breakdown on the Commercial Invoice.

It is significant to remember that commercial shipments into China must adhere to all applicable laws and ordinances. Additionally, they might be governed by limitations and prohibitions. To make sure you have all the necessary paperwork, you might want to get in touch with a freight forwarder if you are exporting from China to Finland.

To ship items by air, you must use an airway bill. A waybill is a legal document that binds the shipper and the carrier and details the shipment's journey from point of origin to point of destination. An airway bill is a binding legal agreement. It is a non-negotiable document that must contain the sender's name, address, the port of destination, and the contents' value.

A traditional bill of lading cannot be replaced by an airway bill. Both domestic and international flights can use it. Any delay or damage during an air shipment is the carrier's responsibility. At the port of discharge, the bill of lading must be turned over to the carrier's agent.

Speaking with your carrier is the best way to find out more information about the airway bill. They will provide you with all the details you require so that you can choose the shipping option for your Courier services China to Finland that is best for you.

Matic Express was founded in Shenzhen, China, in 2007. The Changsha Chaintech Supply Chian Management Co, Ltd branch, which manages air and sea shipping as well as express truck shipping, railroad freight shipping, LCL terms, FCL, DDU, and FCL terms, is situated in Changsha, China. We provide door-to-door service in addition to delivering goods to Amazon warehouses, international warehouse addresses, and identified addresses.

Through truck shipping, express international railway express, express sea shipping, and express air shipping, Matic Express offers freight service to the Amazon world. The nations we serve include the USA, Canada, France, Germany, Poland, Italy, Spain, Japan, New Zealand, and the United Arab Emirates. We will pick it up, deliver it to your local doorstep, put an Amazon label on the book, clear customs, and do all of that.

Rail, air, and sea freight are all available for door-to-door shipping from China through Matic Express.

Matic Express has its own warehouses where your products can be stored. Our storage facilities can be found in Shenzhen, Yiwu, Ningbo, Shanghai, Guangzhou, Dalian, and other cities. We'll come pick it up from your storage facility. Your suppliers or you yourself provide the goods for our warehouse. We can provide you with services like stick labels, cargo inspections, and measurements of the size and weight of your cargo in addition to delivery.

Depending on the nature and characteristics of the imported goods, the importer must pay duties and taxes during customs clearance from China or for Fast Delivery China to Finland. The costs of shipping and insurance do not include these duties. The Common Customs Tariff of the European Communities serves as the basis for calculating import duties.

The cost of imported goods is significantly influenced by customs fees. The commodity code, the item's customs value, and the tariff rate all influence the amor for ount of duties that must be paid. Some products are also exempt from customs taxes.

The three main types of import taxes are excise duty, value added tax, and customs duty. The most significant of these taxes is the customs duty.

Typically, the customs duty is a portion of the merchandise's customs value. Typically, the price of the goods or the cost of transportation makes up this value. An importer may occasionally request a refund of overpaid taxes. Importers have the option to ask for a second investigation of the goods if the customs office declines to accept a refund. Upon approval of re-investigation, the importer has three months to file an appeal.