Find a reputable Customs Clearance Company that can ease your voyage, whether you are importing products from abroad or exporting things abroad. You must bear many things in mind to make sure the process proceeds without a hitch. This involves ensuring that the appropriate paperwork is obtained, taxes and tariffs are paid, and your items are cleared at the appropriate customs office with amazaon fba.

Trade representatives, government organizations, and CBP can access real-time data through the ACE Secure Data Portal from a single, consolidated window. It avoids duplication and speeds the import and export operations.

Users can examine and submit import and export entries using the ACE Secure Data Portal in addition to giving government agencies a single online access point with pick up. This gives a mechanism to monitor daily operations, detect compliance problems, and enhance compliance.

The ACE Portal makes use of cutting-edge capabilities to streamline trade procedures. It can be used to examine national trends, find systemic faults, and increase compliance with trade rules. Additionally, the portal allows users to locate entries that the CBP is examining.

There are numerous advantages to outsourcing customs brokerage processing. These include minimizing mistakes, speeding up customs clearance, and fostering client trust. You can avoid the bother of handling these jobs internally by working with a BPO service.

Making and completing customs documentation is a difficult task. It necessitates in-depth familiarity with and comprehension of both domestic and foreign security protocols. With so many variables, it's crucial to work with a knowledgeable broker to guarantee that the right taxes and charges are paid with express.

The top customs brokers will be equipped to tackle any difficulties. It is especially crucial to stay up to date with changes to the legislation and regulations. You risk paying significant fines if your paperwork is not properly prepared. Payments made using incorrect duty estimates may likewise be wrong.

Anti-dumping and countervailing tariffs on imports are investigated by and issued by the US Department of Commerce (DOC). If importers don't pay the proper duties, they could face fines and even jail time.

The majority of CVD investigations concentrate on figuring out specificity and benefit quantities. The completion of an order can take anywhere from 12 to 18 months. Importers sometimes are unaware of the regulations to which they are subject.

Importers can collaborate with an import broker to detect AD/CVD orders. For additional in-depth information, they can also refer to the DOC's Anti-Dumping and Countervailing Duty Whitepaper. Certain importers misrepresent the genuine nature of their products in transportation.

Declaring that the imported products are covered by an AD/CVD order necessitates the submission of a new entry. The ultimate duty liability on the subject entries will be calculated by the DOC, along with the expected rate of duty. Additional obligations might be imposed depending on the order's scope. The duty rate may significantly increase when more tasks are added to an entry.

A number of documents are necessary for customs clearance of goods. Please check with the destination country since different products and nations have different rules and regulations.

The bill of lading is among the most significant customs clearance documents. This is a formal document that certifies the contents of the package and is signed by the shipper and the carrier. It includes the shipment's weight, amount, and destination.

The commercial invoice is another document required for import customs clearance. This document lists the product's precise selling price and freight insurance. The delivery terms and conditions are also included.

The test report is yet another typical document used to clear freight. This report was produced by a lab that the government has approved. The customs official can determine if the goods qualifies for clearance when the testing is complete.

Matic Express was started in 2007 and is headquartered in Shenzhen China. Changsha Chaintech Supply Chian Management Co, Ltd is located in Changsha China, has a branch. Our main business is air & maritime shipping, express, railway, truck shipping, and freight with DDP, DDU, FOCL, or LCL terms. We ship goods to Amazon warehouses, warehouses in the overseas, identified addresses, as well as door-to-door service.

Matic Express provides freight service to global Amazon through sea shipping, air shipping, express, international railway express, and truck shipping. USA, Canada. France. Germany. Poland. Italy. Spain. Japan. New Zealand.

Matic Express delivers door-to–door, regardless of whether it's railway express or sea freight. We also offer truck shipping, DDP & DDU for the door to.

Matic Express maintains its own warehouses so that your cargo can be kept in storage. There are warehouses at Shenzhen Yiwu Ningbo Shanghai Guangzhou Guangzhou Dalian Chongqing. We collect it from any warehouse. You, your suppliers or you may ship your cargo to our warehouse. We offer services like cargo inspections and stick labels, measuring size and weight, and delivery with walmart delivery.

The taxes and tariffs incurred by your imports should be taken into consideration while transporting your goods from point A to point B. Any plan for delivering goods internationally must include import charges.

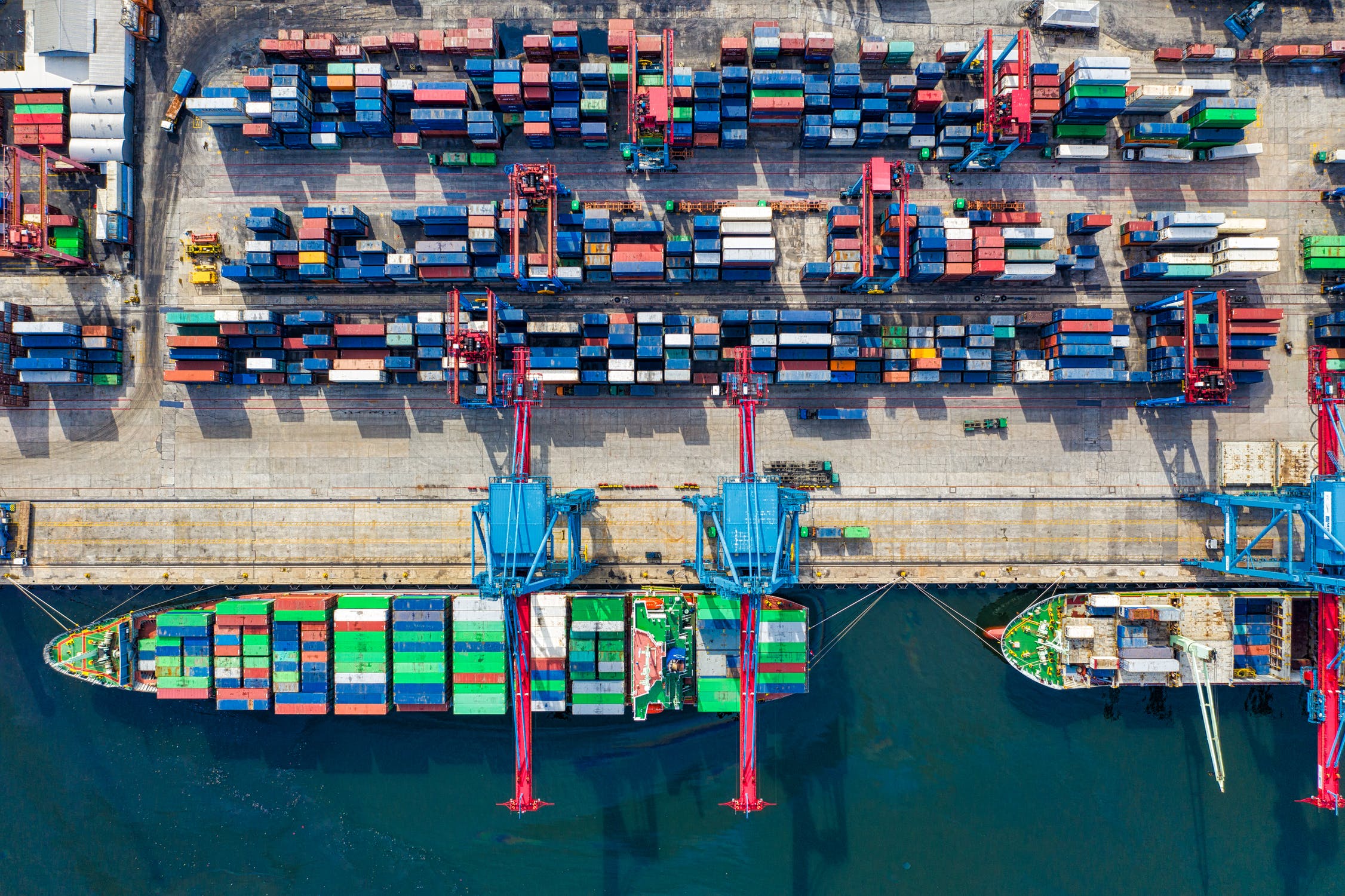

When it comes to moving your goods from point A to point B, there are numerous things to take into account, such as shipping costs, the time it takes to go from port to port, and the customs and charges that may be imposed on your imports with dhl express. Some of these hassles can be avoided by working with a reputable customs clearance business.

The country you're shipping to determines the tax rate you'll pay for your imports. Although not all nations do, the majority of them have a flat percentage rate. Australia, for instance, levies a 10% Goods and Services Tax (GST).