Whether you are moving from China to Australia or from Australia to China, you must be aware of the process of shipping and customs clearance. You also have to be aware of the tariffs and taxes that you will be liable for. You should also know what documents are needed for the shipping process.

Whether you want to send a little or large shipment, there are several considerations to consider when shipping container DDU from China to Australia. You must also consider the timing and storage of your shipment. First, you must locate a freight forwarder. A freight forwarder will collect the cargo from your source, clear customs, and transport it to your destination. They are also in charge of all fees and paperwork. After you've identified a freight forwarder, you'll need to choose a port. Ports differ in terms of location and simplicity of customs clearance. You can save time and money by selecting a port. You must also evaluate the trade terms. The cost of transporting a container DDU China to Austria will be determined by these trade rules. You may end yourself paying more than you planned depending on the terms you chose.

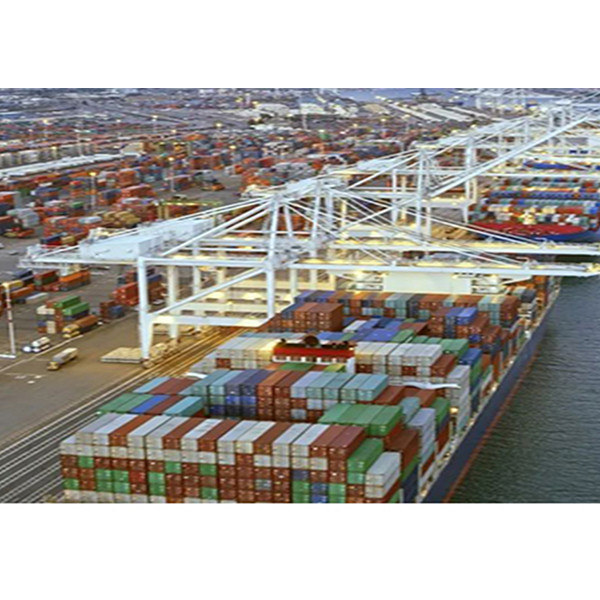

Whether you are shipping a box or a large shipment, shipping from China to Australia takes a little bit of time. The speed of shipping depends on several factors. In particular, the type of goods you are shipping and the route you are using. In general, shipping from China to Australia takes around 16-30 days. If you are shipping your goods by air, your time to arrive in Australia will vary depending on the airline and port you use. The time you spend clearing customs in your destination port may also affect the delivery time. You may want to hire a customs clearance service to help you. Shipping from China to Australia by sea is the most cost-effective method. You can choose from different ports, including Shanghai, Shenzhen, and Melbourne. Shipping costs vary depending on the port, time of year, and mode of transportation.

Whether you're sending something from China to Australia or sending a gift to someone else, you should have the right paperwork. Some of these are an air waybill, a packing list, and a cargo transit document. The customs officials can check the contents of your shipment with the help of these papers.

A packing list shows all of the things that are going to be sent. This helps the people at the customs office figure out how much import duty to charge. A bill of lading is like an air waybill. Once goods are put on a ship, they are used as receipts. Clearing customs is a hard process. You should hire a freight forwarder to help you with this part of the shipping process. They can also do important things to help. You should also look at the list of things that can't be brought in. This will keep you from getting fined a lot by customs.

Whether you are an immigrant relocating to Australia or a business that has a large consignment of goods to export, you will need to know how to get your goods cleared at Customs. Choosing the right freight forwarder is important to ensure that your consignment complies with the shipping rules. Several factors affect the delivery time of a consignment. For example, the transit time can vary from several days to weeks. The number of carriers on the shipping route may also affect the time it takes to get your goods to your destination. You can also choose a shipping medium, such as air or sea freight. The cost of shipping is determined by the quantity of goods and the nature of your cargo. Choosing the right option can save you money.

Matic Express was founded in 2007. The headquarters is located in Shenzhen China. Changsha Chaintech Supply Chian Management Co, Ltd is a subsidiary of Changsha China, is our main business. We are specialized in air & sea shipping express, railroad, truck delivery, and truck shipping with DDP, DDU, FLC, or LCL terms. We ship products to Amazon warehouses, warehouses in overseas with a designated address and door-to-door services.

Matic Express offers freight service for global Amazon through air freight, sea shipping Express, International railway express, or truck shipping. Our service scopes are USA, Australia, Canada, France, Germany, Poland, Italy, Spain, Japan, New Zealand and UAE, etc, pick up, delivery, Amazon label, placing, booking customs clearance, as well as local delivery to doorstep.

Matic Express offers door to-door shipping to China that includes air, rail and sea freight.

Matic Express maintains its own warehouses so that your cargo can be stored. There are warehouses at Shenzhen Yiwu Ningbo Shanghai Guangzhou Guangzhou Dalian Chongqing. We will take it to your warehouse. Our warehouse can be delivered to you by suppliers or yourself. We offer services to you like cargo inspections. Labels to stick. Measurement of weight and size. Delivery.

When you buy items from China, it is important to have a thorough grasp of the various taxes and customs that apply to DDU containers traveling from China to Australia so that you can make an educated purchasing decision. The amount of tax that will be applied to your purchase is going to be determined by the kind of product that you are purchasing. Because of the potential for ambiguity around import taxes, it is essential to have a solid understanding of both what these taxes are and how they are computed. It is highly recommended that you seek the advice of a customs broker whenever you are importing expensive items. On the other hand, if the things that you are ordering for your company are of a little value, you might decide against calculating the applicable taxes. Goods that are imported in excess of their allotted quota are subject to additional customs taxes. If the total amount of the duty is greater than the "de minimus value," then penalties might be imposed. There are a number of different rates of duty, but approximately five percent is the average.